The solution is available to Customers integrated with Antaca. For more information about Antaca service please open [this link](https://developer-quicko.verestro.com/books/card-management-system)

## How to connect with us? Verestro provides access to the solution in in two ways, depending on the Customer requirements. The Customer can access the IBAN Management solution through Mobile SDK or REST API implementation models. ### Mobile SDK Verestro provides an integration model that allows Customers to get and show generated IBANs on the mobile applications. Methods in this integration model are secured with an authorization token from Mobile DC. More detailed information about the integration with IBAN Management for mobile are available in Technical documentation chapter**.** Verestro actively supports the Customer in the integration process. ### REST API Verestro provides an integration model that allows Customers to get and show generated IBAN's through server to server connection. Methods in this integration model requires x509 certificate authentication. More detailed information about IBAN Management API integration are available in Technical documentation chapter**.** Verestro actively supports the Customer in the integration process # Overview This document provides high level description of functionalities offered by IBAN Management Service. Solution allows to generate IBAN as a reaction to the created balance, thus enabling transfers using the IBAN number. The solution is very simple to integrate as most of the processes, such as handling transfers, are performed by the payment institution and the Verestro backend. Detailed information about the integration is available in the Technical documentation chapter. To use the application the creation of the Customer account in the IBAN Management Service and integration with the Antaca service - which is responsible for generating balances - are required. More information about balance generating is available in the Antaca Create User Balance documentation. The IBAN is created in response to the created balance and is a kind of indicator for this balance. ## Abbreviations This section shortly describes abbreviations and acronyms used in the document.| **Abbreviation** | **Description** |

| SDK | Software Development Kit |

| API | Application Programming Interface |

| IBAN | International Bank Account Number |

| OS | Operative System |

| IMS | IBAN Management Service |

| THC | Transaction History Core |

| AP | Admin Panel |

| **Name** | **Description** |

| IBAN | International bank account number, which is a standard international account number. IBAN consists of the: - two-digit country code (ISO) - two-digit control number - account number IBAN length may be different depending to country. More detailed information about IBAN can be find in IBAN generating chapter. |

| Base IBAN / IBAN prefix | Base IBAN issued to the Customer by the IBAN Issuing Institution. Each base IBAN is issued per currency and is necessary to generate new IBANs in the context of each Customer. |

| Balance | Current amount that is in our bank account and is available for use at any time. Each transfer with an IBAN assigned to another account reduces the balance of our bank account. In turn, each top up on our account causes the account balance to increase. |

| Customer | Institution which is using Verestro products. Basically Customer can be called Verestro client. |

| IBAN Issuing Institution | Verestro partner who's assigning base IBANs to IMS Customers and settles IBAN transfers. This institution contacts with the Bank. This means that the responsibility for the settlement of the transaction is beyond the Customer. More detailed information about base IBAN can be find in IBAN generating chapter. |

| Bank | The Bank contacts the IBAN Issuing Institution informing about transfers that need to be settled. |

| Currency | Monetary unit - the name of the money used in a given country. This name is used primarily in the context of international exchange. To see the list of the supported currencies please visit Supported currencies chapter. |

| Transaction file | A file with the .pli extension containing information about bank transfers. On the basis of this file, balance transfers and debits are generated in response to transfers made using the IBAN number. These files are created by the Bank being a partner of Verestro and only IBAN Issuing Institution employees have access to them. |

| **Component** | **Description** |

| IBAN Management Service | Backend component that allows Customer to issue IBANs. It is also responsible for handling debits and credits of a given balance if the operation performed is an IBAN transfer. To do so this service communicates directly with Antaca. In addition, IMS is responsible for validating each transfer order. |

| Antaca | Backend component that is responsible for creating balances for Customers. After creating the balance, Antaca sends an event. On the basis of this event the IMS creates an IBAN assigned to the created balance. It is a key component without which IBAN transfers are not possible. More information on Antaca balances can be found [here](https://developer.verestro.com/books/card-management-system/page/overview#bkmrk-user-balance). |

| Admin Panel | Web component that allows to create a panel for the Customer so that he can see his endusers' IBAN numbers (the IBAN number is not a sensitive value) and can track transactions performed by these IBAN's. Through the Admin Panel, transaction files are also uploaded. To see an sample view of the Panel and the user experience of the Admin Panel, please visit the Use Cases chapter. |

| Transaction History Core | Backend component responsible for storing details of the performed transactions. Transaction information stored in THC is provided, among others, to the Admin Panel so that allows the Customer to tracking transaction made by his endusers. Transactions stored in THC are also transferred to the enduser's as a history of debits and account top-ups. Eventually THC is also able to send transaction notifications to the Customer. |

| Mobile SDK | Integration via mobile SDK has been made available to Customers who want to connect to the IBAN Management service via mobile applications. In this solution, the Customer authorizes himself using a session token previously obtained from the Mobile DC service. Details of integration via mobile SDK are available in the Technical documentation chapter. |

| REST API | Server-to-server integration has been made available for Customers who want to connect to the IBAN Management website directly from their backend. This type of integration was created in accordance with the REST architectural pattern. In this solution, the Customer authorizes himself with a signed x509 certificate. Details of integration via REST API are available in the Technical documentation chapter. |

| [IBAN generating](https://developer.verestro.com/books/iban-management/page/overview#bkmrk-iban-structure) | An element of the solution that is responsible for generating IBANs using a special algorithm based on the base IBAN that Customer received from the IBAN Issuing Institution. |

| [IBAN transfer receiving](https://developer.verestro.com/books/iban-management/page/overview#bkmrk-iban-transfer-receiv) | An element of the solution responsible for handling incoming transfers to the received IBAN and thus for initiating the process of topping up recipient's balance. |

| [IBAN transfer sending](https://developer.verestro.com/books/iban-management/page/overview#bkmrk-iban-transfer-sendin) | An element of the solution responsible for handling outgoing transfers and thus for initiating the sender's balance charging process. |

| Two-letter country code according to the ISO-3166 standard (for Poland these are the letters PL). |

| Two-digit control number and the BBAN bank account number according to the system selected in a given country and a given bank. The BBAN account number can be of any length (up to 30 characters), but the length must be fixed for a given country. |

| The account number may contain numbers 0-9 and capital letters of the Latin alphabet A-Z. |

**Example:** Polish IBAN numbers consist of 2 letters of the country and 26 digits according to the following division PL00123456789090909090909090.

| PL | 2 letters of the country. |

| 00 12345678 | 2 digits of the checksum and 8 digits tracking a given bank and, for example, it's specific branch. |

| 9090909090909090 | 16 digits tracking a specific account. |

| PLN | Polish zloty |

| EUR | Euro |

| USD | American dollar |

| GBP | British pound sterling |

| CHF | Swiss franc |

| AUD | Australian dollar |

| CAD | Canadian dollar |

| CZK | Czech koruna |

| DKK | Danish krone |

| NOK | Norwegian krone |

| SEK | Swedish krone |

| HUF | Hungarian forint |

| JPY | Japanese yen |

| MXN | Mexican peso |

| ZAR | South african rand |

| TRY | Turkish lira |

| BGN | Bulgarian lev |

| RON | omanian leu |

| CNY | Chinese yuan |

| THB | Thai baht |

| ILS | Israeli new shekel |

| HKD | Hong Kong dollar |

Implementation work in progress...

## Admin Panel Using the Admin Panel service allows the Admin Panel operator to perform various actions related to IBAN transfers. Actions of this type include, among others, filtering endusers and their IBANs, tracking the history of enduser's transactions and their account balances, as well as execution of the ordered transfers. The operator of the Admin Panel is an employee of a given institution. Basicly it can be a person representing the Customer's institution or an employee of the IBAN Issuing Institution. Each of the operators has an assigned role in the Admin Panel, which determines what actions in the Admin Panel they can perform. For more detailed information please visit Admin Panel use cases chapter.After creating an Admin Panel instance in the context of IBAN Management Service for a given Customer, remember to provide the domain of this instance. We need to add this domain to the whitelist. Otherwise, IBAN Management Service API will reject every request with HTTP status 403 - Forbidden. *Example domain to be provided for whitelisting: https://admin-panel-customername.verestro.com*

# Use cases This chapter contains the description of the processes taking place in the IBAN Management Service from the point of view of the Customer and the end user. Information on how to integrate with the solution has also been added. ## IBAN transfer receiving This functionality allows user to receive transfers. User which is using Customer's application is able to share his IBAN to potential payer. This type of transfer is a transaction that top ups user's balance. As receiving an incoming transfer requires only to provide IBAN to his potential payer, the only functionality which the Customer must handle is IBAN displaying. For integration details please visit Technical documentation chapter. ### Display IBAN The user who logs in the Customer application sees his balance and the IBAN that is assigned to this balance. This allows him to share such IBAN to a potential payer so that the payer can make a transfer to the user's account. Having a visible IBAN, the user can also top up his balance by making a bank transfer from his external account. The IBAN can be displayed by using the `getIban` and `getIbanMobile` methods depending on the implementation model used by the Customer. The implementation model also defines the method of Customer authorization in the IMS service. In the case of the Mobile SDK implementation model, the Customer authenticates using a session token received from Mobile DC. In the case of the REST API implementation model, the Customer authenticates through signed x509 certificate. #### Mobile SDK integration The Mobile SDK implementation model was created for Customers who want to share the IBAN Management Service solution through their mobile application. In order for the Customer to be able to provide its users with access to their IBAN's, it is necessary to make a request to the IMS service. The functionality that returns the user's IBANs is secured - Customer authorization is required. This process consists in transferring a Mobile DC session token during the request to get the list of IBANs. To integrate with the getIbanMobile method, please visit the Technical documentation chapter. @startuml skinparam ParticipantPadding 30 skinparam BoxPadding 30 skinparam noteFontColor #FFFFFF skinparam noteBackgroundColor #002060 skinparam noteBorderColor #002060 skinparam noteBorderThickness 1 skinparam sequence { ArrowColor #002060 ArrowFontColor #002060 ActorBorderColor #002060 ActorBackgroundColor #FFFFFF ActorFontStyle bold ParticipantBorderColor #002060 ParticipantBackgroundColor #002060 ParticipantFontColor #FFFFFF ParticipantFontStyle bold LifeLineBackgroundColor #002060 LifeLineBorderColor #002060 } participant "User" as user participant "Customer App" as issuer participant "Mobile DC" as mdc participant "IBAN Management Service" as ims note right of user: User opens Customer mobile app user->issuer: Check my IBAN issuer->mdc: Get session token issuer<-mdc: Return session token issuer->ims: Get IBAN by balance ID issuer-->ims: Provide Mobile DC session token ims->ims: Validate session token issuer<-ims: Return user's IBAN user<-issuer: Display IBAN to the user @enduml #### REST API integration The REST API implementation model was created for Customers who want to connect with the IBAN Management Service through their backend. In order for the Customer to be able to provide its users with access to their IBANs, it is necessary to make a request to the IMS service. The access to the IMS is secured and requires the Customer to authenticate with [x509 certificate](https://developer.verestro.com/books/iban-management/page/technical-documentation#bkmrk-how-to-generate-csr-). After successful authentication it is possible to get the list of IBANs. To integrate with the getIban method, please visit the [Technical documentation chapter](https://developer.verestro.com/books/iban-management/page/technical-documentation). @startuml skinparam ParticipantPadding 30 skinparam BoxPadding 30 skinparam noteFontColor #FFFFFF skinparam noteBackgroundColor #002060 skinparam noteBorderColor #002060 skinparam noteBorderThickness 1 skinparam sequence { ArrowColor #002060 ArrowFontColor #002060 ActorBorderColor #002060 ActorBackgroundColor #FFFFFF ActorFontStyle bold ParticipantBorderColor #002060 ParticipantBackgroundColor #002060 ParticipantFontColor #FFFFFF ParticipantFontStyle bold LifeLineBackgroundColor #002060 LifeLineBorderColor #002060 } participant "User" as user participant "Customer App" as issuer participant "IBAN Management Service" as ims note right of user: User opens Customer web app user->issuer: Check my IBAN issuer->ims: Get IBAN by balance ID issuer-->ims: Provide x509 certificate ims->ims: Validate certificate signature issuer<-ims: Return user's IBAN user<-issuer: Display IBAN to the user @enduml ## IBAN transfer sending This functionality allows user to order outgoing transfers. User which is using Customer's application is able to sends money on a given IBAN. The outgoing transfer is a transaction that charges user's balance.Implementation work in progress...

## Admin Panel One of the additional functionalities that Verestro provides is the creation of an administration panel that allows the Customer to track the history of users' transactions - individual banking operations such as debiting or topping up the account with the transfer IBAN are visible. The Admin Panel also provides information such what IBAN is assigned to the secified user and and which balance this IBAN refers to. The Admin Panel is configured mainly on the Verestro side. Each instance of the Admin Panel is issued per Customer. The below diagram shows the processes of filtering users and their IBAN numbers:Process available for Admin Panel operetor with every type of Admin Panel operator roles.

@startuml skinparam ParticipantPadding 30 skinparam BoxPadding 30 skinparam noteFontColor #FFFFFF skinparam noteBackgroundColor #002060 skinparam noteBorderColor #002060 skinparam noteBorderThickness 1 skinparam sequence { ArrowColor #002060 ArrowFontColor #002060 ActorBorderColor #002060 ActorBackgroundColor #FFFFFF ActorFontStyle bold ParticipantBorderColor #002060 ParticipantBackgroundColor #002060 ParticipantFontColor #FFFFFF ParticipantFontStyle bold LifeLineBackgroundColor #002060 LifeLineBorderColor #002060 } participant "AP Operator" as issuer participant "Admin Panel" as ap participant "IBAN Management Service" as ims participant "Transaction History Core" as thc note right of issuer: Customer logs in Admin Panel issuer->ap: Log in issuer<-ap: Success note right of issuer: Customer filter IBANs list issuer->ap: Get IBANs ap->ims: Get IBANs by specified query ap<-ims: Return list of found IBANs issuer<-ap: Show list of found IBANs note right of issuer: Customer filter transaction history list issuer->ap: Get transaction history ap->thc: Get transaction history by specified query ap<-thc: Return list of found transactions issuer<-ap: Show list of found transactions @enduml The below diagram shows the processes of the uploading transaction file and the execution of the IBAN transfers:Process available for Admin Panel operetor with Admin Panel `ADMIN` role.

@startuml skinparam ParticipantPadding 30 skinparam BoxPadding 30 skinparam noteFontColor #FFFFFF skinparam noteBackgroundColor #002060 skinparam noteBorderColor #002060 skinparam noteBorderThickness 1 skinparam sequence { ArrowColor #002060 ArrowFontColor #002060 ActorBorderColor #002060 ActorBackgroundColor #FFFFFF ActorFontStyle bold ParticipantBorderColor #002060 ParticipantBackgroundColor #002060 ParticipantFontColor #FFFFFF ParticipantFontStyle bold LifeLineBackgroundColor #002060 LifeLineBorderColor #002060 } participant "AP Operator" as issuer participant "Admin Panel" as ap participant "IBAN Management Service" as ims participant "Antaca" as ant participant "Transaction History Core" as thc note right of issuer: AP Operator uploads transaction file issuer->ap: Upload transaction file ap->ims: Send transaction file note left of ims: The authorization token representing a given Customer in PA is validated ims->ims: Validate Admin Panel authorization token ims->ims: Validate transaction file ap<-ims: Validation success issuer<-ap: Show validation status issuer->ap: Execute transaction file ap->ims: Order transaction file execution ims->ant: Credit/debit balances based on IBANs from the transaction file note left of ant: The x509 certificate of a given Customer context is validated ant->ant: Validate CN ims<-ant: Credit/debit result ant->thc: Report transaction ims->ims: Generated transaction report ims->thc: Report transaction @enduml ### Views This chapter contains views and actions to be performed available to the Admin Panel operator regarding the IBAN Management solution. Depending on the role of the operator's account, various actions are available in the Admin Panel. The roles available in the Admin Panel are `EMPLOYEE`, `MANAGER` and `ADMIN`. More information about roles and their permissions are included further in Views chapter subsections.Depending on the Customer's requirements, the permissions in the Admin Panel can be configurable. For example, it is possible that only `ADMIN` and `MANAGER` can add a new balance from the Admin Panel. `EMPLOYEE`, on the other hand, would only be able to perform `read` actions. Detailed information about roles and permissions configurations are available in the Admin Panel Service documentation.

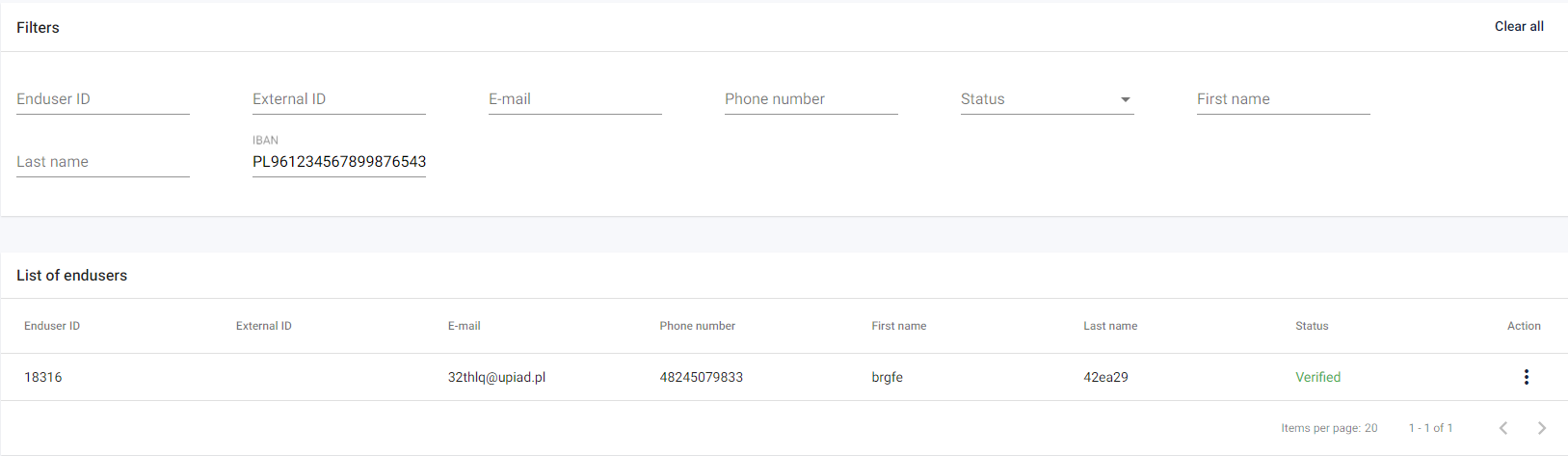

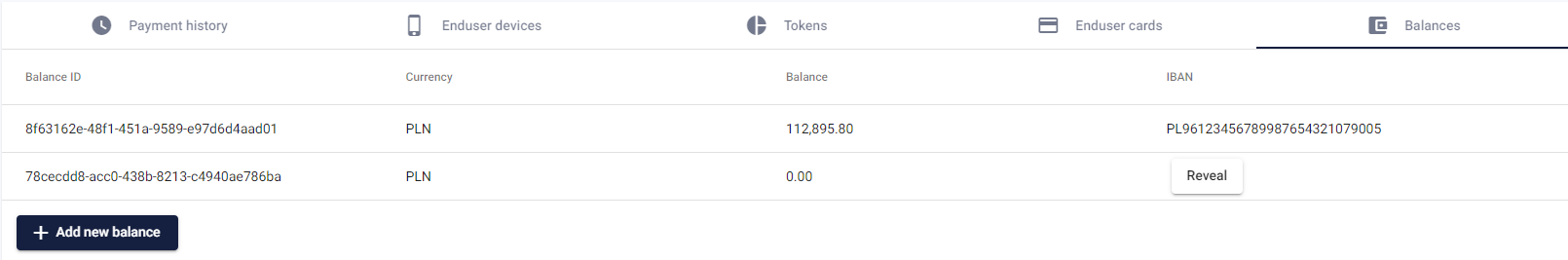

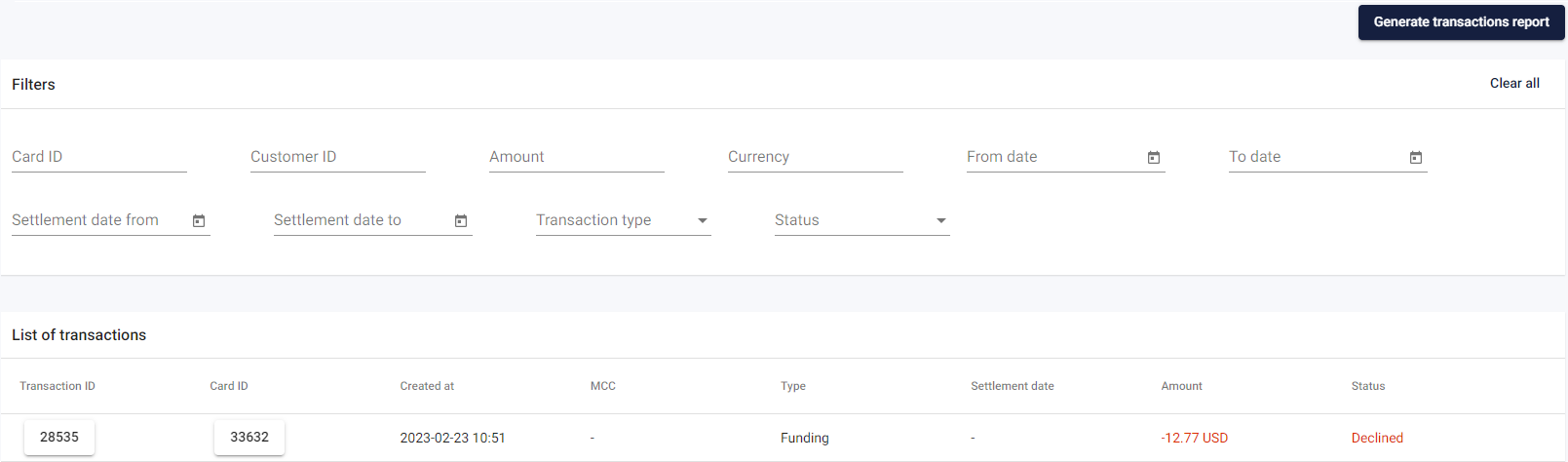

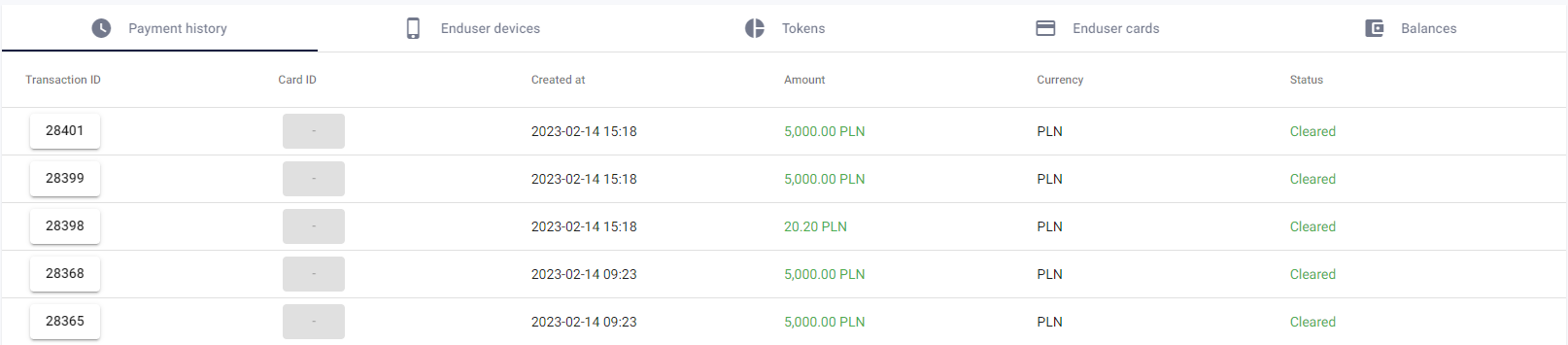

#### Enduser details Each role is entitled to `read` actions. This means that `EMPLOYEE`, `MANAGER` and `ADMIN` can filter their endusers and check their account details such as assigned balances and IBANs. The option of viewing end users is available in the `CUSTOMERS` / `End Users` tab and has been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677147920306.png) Using to the available filters in `Endusers` tab, the Admin Panel operator regardless of his Admin Panel role can find a proper user by various filtering criteria - including the IBAN number. The entered filtering criteria can be cleared using the `Clear all` button in the upper right corner. Available filtering options have been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1676554736454.png) Such the Admin Panel operator is also able to view the details of a given end user by selecting end user's record from the list of all end users. In the end user details section, there are several tabs dedicated to various functionalities - including `Balances` tab with balances details and the same IBANs assigned to these balances. By selecting the `Reveal` option, the Admin Panel operator can view the end user's IBAN number. From the same view, it is also possible to add a new balance to the end user, which will also generate a new IBAN number. Generating a new balance is possible with the `+Add new balance` button in the lower left corner. The action of generating a new balance is also available for each role of the Admin Panel operator. The described posibilities available in `Balances` tab have been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1676555543719.png) #### Payment history Each of the Admin Panel operators also has the ability to view the transaction history of all endusers. The option of viewing end users is available in the `CUSTOMERS` / `Payment History` tab and has been presented one the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677150640402.png) Using to the available filters in `Payment history` tab, the Admin Panel operator regardless of his Admin Panel role can find a proper end user's transaction by various filtering criteria. The entered filtering criteria can be cleared using the `Clear all`button in the upper right corner. After specifying the filtering criteria, the operator can also generate a transaction report using the `Generate transaction report` button in the upper right corner. [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677151269746.png) Such the Admin Panel operator is also able to view the payment history of a given end user by selecting end user's record from the list of all end users. In the end user details section, there are several tabs dedicated to various functionalities - including `Payment history` tab with transaction details performed by selected enduser. The `Payment history` tab have been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677149382343.png) #### Upload transaction fileThe following section describes actions allowed only for Admin Panel operators with `ADMIN` role.

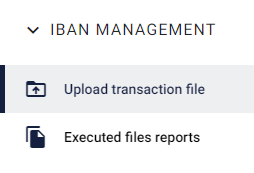

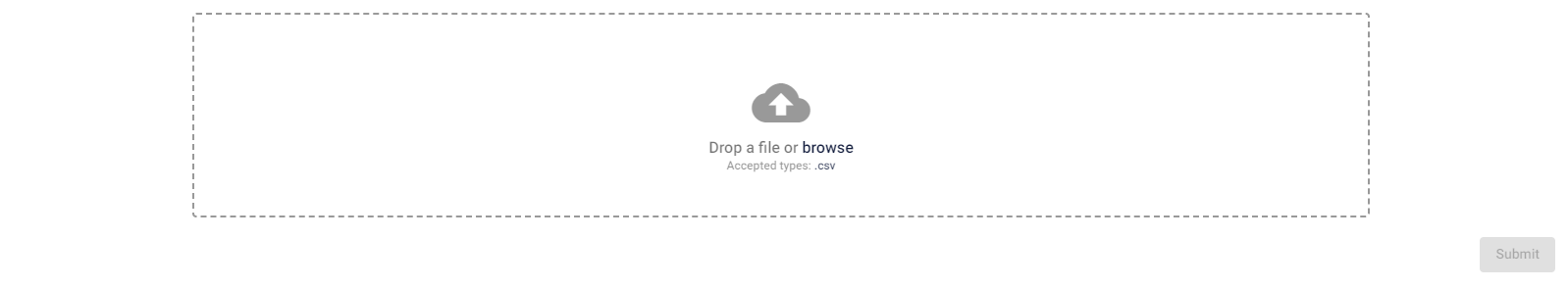

This chapter is devoted to views and processes related to uploading transaction files and their execution. These processes can only be performed by operators with ADMIN role rights and persons legally authorized to perform such operations as ordering and executing transactions. The functionality responsible for uploading transaction files is available in the `IBAN MANAGEMENT` / `Upload transaction file` tab and has been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677152467676.png) After selecting the `Upload transaction file` tab, a dropbox intended for uploading transaction file appears. The Admin Panel operator with the `ADMIN` role has permission to upload such file and confirms the upload with the `Submit` button visible in the lower right corner. The dropbox view has been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677157756676.png) After confirming the upload of the transaction file by the `Submit` button, the validation process begins. During the validation every transaction record contained in the file is checked. The validation result is displayed in the list of uploaded files under the transaction file dropbox.Each file should have a unique name otherwise there is a risk of overwriting a previously uploaded file with the same name.

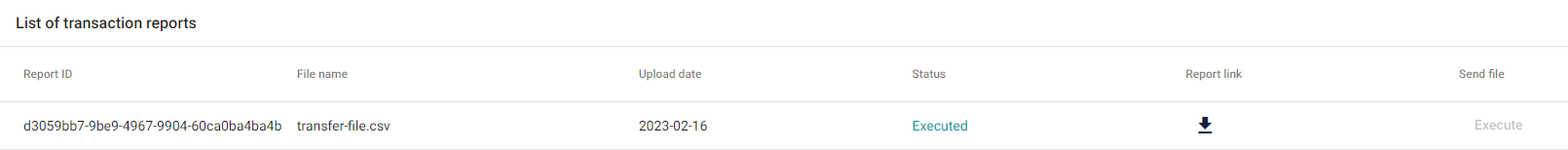

After the validation process, information about whether the file is valid or not valid is displayed. The information about the transaction file validation status is presented in the form of a status in the `Status` column. The list of validation statuses and their meanings are available in the Transaction file validation statuses section. If the file validation was successful, then it is possible to execute transaction file. File execution is performed after clicking the `Execute` button in the `Send file`column. Each transaction file can be sent for execution only once to avoid accidental additionally top up or debit of the given balance. If the validation result of the transaction file is negative, then a proper status in the `Status` column is presented and the validation report file is generated, available for download by the Admin Panel operator. The Admin Panel operator can download such validation report by clicking on the `arrow button` in the `Report link` column. Appearance of the list of uploaded transaction file has been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677157946455.png) ##### Transaction file validation statuses| **Status** | **Description** |

| Validated | Transaction file upload completed successfully. Validation returned positive status. Ready for execution. |

| Executed | Transaction file already executed. |

| Executing | Transaction file execution is progress. |

| Pending | Transaction file validation in progress. Execution is not possible. |

| Invalid | Transaction file validation returned nagative status. Execution is not possible. |

The following section describes actions allowed only for Admin Panel operators with `ADMIN` role.

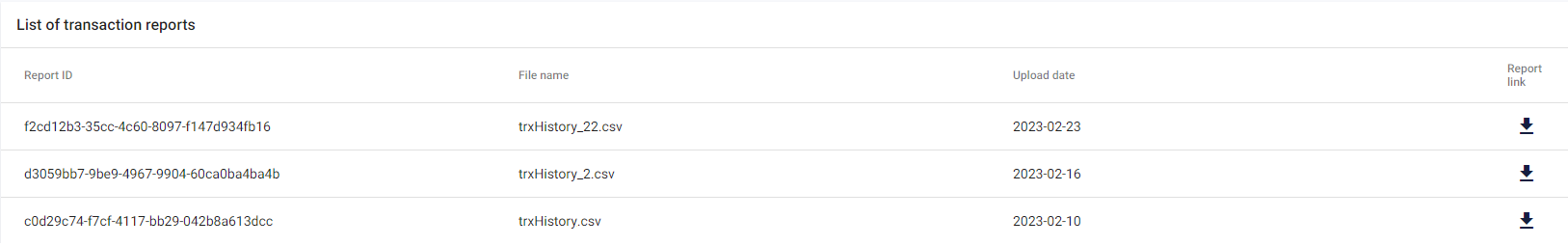

This chapter is devoted to views and process related to downloading executed transaction reports. These processes can only be performed by operators with ADMIN role rights and persons legally authorized to perform such operations as ordering and executing transactions. The functionality responsible for uploading transaction files is available in the `IBAN MANAGEMENT` / `Upload transaction file` tab and has been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677161299855.png) After selecting the `Executed files reports` tab, a list of the all transaction reports appears. List contains information about each of the generated reports: date of the report generation, name of the report and it's identifier. There is also posibility to download such report by clicking on the `arrow button` in the `Report link` column. The list of the executed transaction reports view has been presented on the picture below: [](https://developer.verestro.com/uploads/images/gallery/2023-02/image-1677235485592.png) `` ## Notification after transaction One of the additional functionalities offered in the IMS solution is sending transaction notifications to the Customer. The notification is sent in the form of an event that should be handled by the Customer. The Customer should create `POST`type endpoint to allow us to send such an event. ```JavaScript POST https://example-customer-site.com/transaction-event { "id": 20, "timestamp": 1665557034 } ``` Transaction event contains the transaction identifier as has been shown in example above. Using this identifier, the Customer can get the details of a given transaction using the appropriate method. It is also possible to get a list of all transactions. Implementation details are available in the technical documentation of the Transaction History Core service. @startuml skinparam ParticipantPadding 30 skinparam BoxPadding 30 skinparam noteFontColor #FFFFFF skinparam noteBackgroundColor #002060 skinparam noteBorderColor #002060 skinparam noteBorderThickness 1 skinparam sequence { ArrowColor #002060 ArrowFontColor #002060 ActorBorderColor #002060 ActorBackgroundColor #FFFFFF ActorFontStyle bold ParticipantBorderColor #002060 ParticipantBackgroundColor #002060 ParticipantFontColor #FFFFFF ParticipantFontStyle bold LifeLineBackgroundColor #002060 LifeLineBorderColor #002060 } participant "Transaction History Core" as THC participant "Customer's Server" as issuer THC->issuer: Send notification event issuer->THC: Get transaction details by received transaction id issuer<-THC: Return transaction details @endumlThis is an optional feature, but we recommend using it.

# Onboarding This chapter describes the steps that must be performed in order for the Customer to use the IBAN Management Service solution.| - [ ] Integration with Antaca Service. This requirement is needed so that the Customer has his own dedicated space to generate and store his users' balances in the Verestro system. |

| - [ ] Signing an agreement with the IBAN Issuing Institution. Verestro actively helps the Customer to go through this step. This institution issues the base IBAN and settles transfers made in the context of the Customer. |

| - [ ] Providing the base IBAN to Verestro. This step is directly related to signing an agreement with the IBAN Issuing Institution, which issues such a base IBAN to Customer. On its basis, IBANs of each user of the integrated Customer are generated.

Each base IBAN is created for a specific currency. For example, if the Customer wants IBANs to be generated in EUR and PLN, he must provide two base IBANs - one in EUR and the other one in PLN. |

| - [ ] Creation of a technical balance in Antaca. This is the balance to which failed transfers will be credited. For example, a transfer to IBAN, which does not exist in the Verestro system. |

| - [ ] Generating and delivering an x509 certificate for signing. This certificate will be used to authorize the Customer.

- [ ] x509 commonName - this value is provided by the Customer in the CN parameter when [generating the CSR file](https://developer.verestro.com/books/iban-management/page/technical-documentation#bkmrk-how-to-generate-csr-).

This step is only required for server to server integration. Mobile-server integrating Customers can ignore this point. |

| - [ ] Integration with Mobile DC secure. The Mobile DC service allows you to generate a session token needed to authorize the Customer and get the context of the appropriate user.

This step is only required for mobile to server integration. Server-server integrating Customers can ignore this point. |

If the Customer has an Admin Panel created it is necessary to provide the domain of this instance. We need to add this domain to the whitelist. Otherwise, IBAN Management Service API will reject every request with HTTP status 403 - Forbidden. *Example domain to be provided for whitelisting: https://admin-panel-customername.verestro.com*

# Technical documentation #### Server to server integration This chapter provides technical information about the integration with IBAN Management Service using REST API integration model. @swagger="[https://iban-management.upaid.pl/doc/server.yaml](https://iban-management.upaid.pl/doc/server.yaml)" ##### How to generate CSR file To generate CSR file follow below instruction. The file must be sent to Verestro - we will sign it and return a valid certificate in a response.| **An example completed certificate fields** |

| `Common Name (CN) - V-Companyname-ApplicationName` |

| `Organization (O) - Company name` |

| `Organizational Unit (OU) - free text` |

| `City/Locality (L) - free text` |

| `State/County/Region (S) - free text` |

| `Country (C) - Two-letter country code where organization is located.` |

| `Email Address - Email in case of forced renewal of the change` |

There is a temporary issue with rendering mobile [technical documentation](https://iban-management.upaidtest.pl/swagger-ui/index.html). To view the technical documentation, please follow [this link.](https://iban-management.upaidtest.pl/swagger-ui/index.html)