- Token Management Platform (Server solution) - backend component.

- Wallet Admin Panel - frontend component.

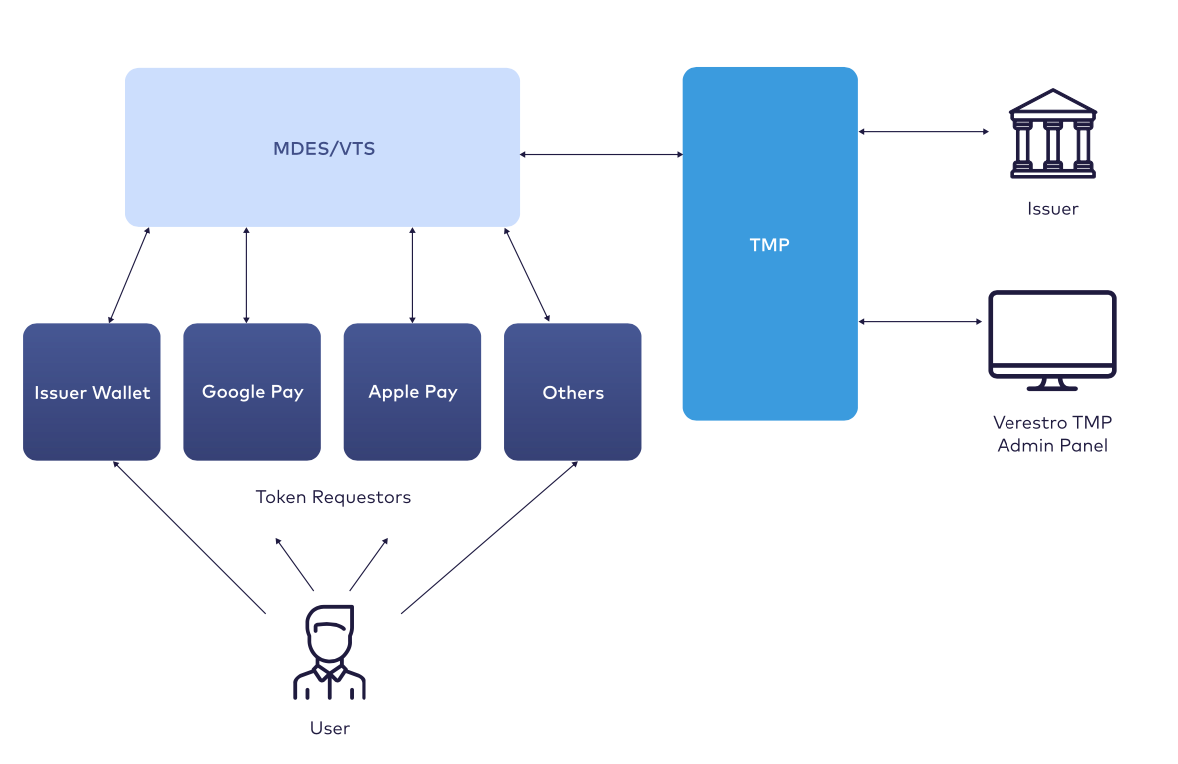

### Architecture

[](https://developer.verestro.com/uploads/images/gallery/2022-06/image-1654848249152.png)

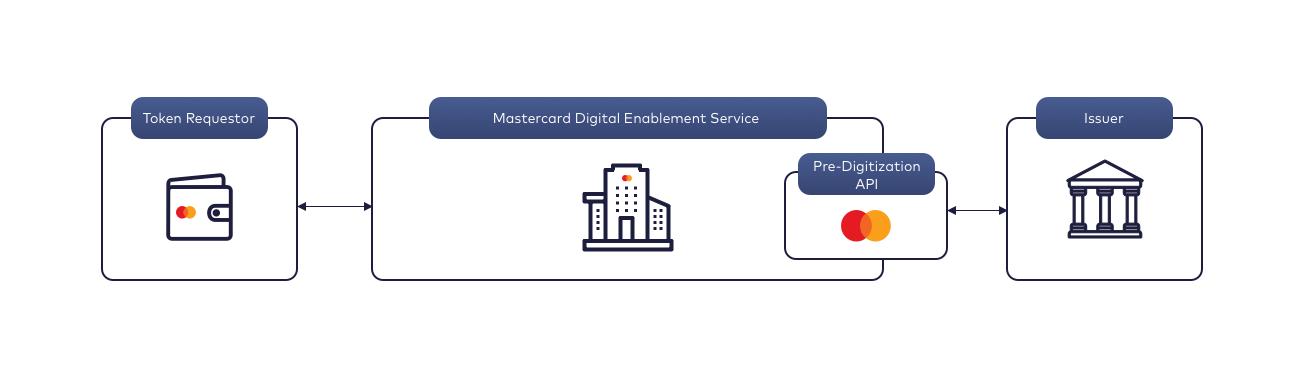

### Pre-digitization

Pre-digitization is a set of processes that allows to a generation of digital payment tokens to enable simpler and secure digital payment experiences. Simply it turns a payment card into a digital token. In this process, Verestro TMP is taking care of all the requirements from Token Requestors.

For this process, the Issuer needs to expose one API method, which will return card verification result or security code verification result.

**Tokenization process**

1\. User enters the card into Apple Pay/Google Pay or another Token Requestor wallet.

2\. TMP receives Authorize Service request from TSP(MDES/VTS) on Pre-digitization API with Card Number, CVC, Exp Date, Device Score, and other tokenization data provided by Token Requestor.

3\. TMP checks device score, number of already active tokens, and velocity controls.

4\. TMP sends a request to Issuer Card Verification API with a Card Number and receives the Card Status, Card ID, User Phone Number, CVC validation Result, Product Category.

5\. TMP returns the decision to TSP (APPROVED/REQUIRE\_ADDITIONAL\_AUTHENTICATION/DECLINED).

**Token activation**

If the decision is APPROVED - token activated instantly after Authorize Service response. Verestro TMP can also notify the issuer if required.

If the decision is REQUIRE\_ADDITIONAL\_AUTHENTICATION - The message will be displayed to the user with activation options (ex. SMS OTP). After the user selects the activation type, TSP will send a DeliverActivationCode to Verestro TMP. Verestro TMP will send the OTP activation code to the user. After the user enters the OTP, TSP activates the token. The token can also be activated manually via the Administration Panel.

If the decision is DECLINE - a token becomes INACTIVE and cannot be activated again.

When a token is activated, Verestro TMP will receive a notifyServiceActivated call from TSP.

[](https://developer.verestro.com/uploads/images/gallery/2022-06/image-1654848303648.png)

#### User authentication

- Green Path - Path without user confirmation (authentication) during the token activation process. The payment token is automatically activated.

- Yellow Path - Path with user confirmation (authentication) during the token activation process. Payment token is activated after correct OTP is provided.

- Orange Path - Path with user confirmation (authentication) during the token activation process. Payment token is activated by the Bank after the user's request via call.

- Red Path - Path when the Issuer rejected activation payment token during the token activation process.

- Verestro TMP sends OTP code via SMS or email (configurable option) to the Account Holder, but there is also possibility to do that by the Issuer, in that case Verestro TMP will notify the Issuer and then Issuer sends it to the Account Holder,

- Account Holder is entering received OTP and TSP or Verestro TMP(configurable) is validating it,

- When OTP code is correct, notifyServiceActivated method is called which means that token is activated and ready to use.

- OTP code for additional authentication.

- Notifications when a token is activated or deleted.

- Notifications to inactive customers, which didn't perform any transactions after token activation.

- Notifications on abandoned provisioning, when a user didn't finish the full process of token activation.

- Delete inactive tokens after a configured time.

- Generate reports.

- Send notifications.

- Fetch transactions from Customer Service, which can be used for reporting and accessible from administration panel.

- Grafana dashboard with tokenization activity and performance metrics.

- Statistics.

- Error and warning alerting.